SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantxþ Filed by a Party other than the Registrant o¨ Check the appropriate box:

¨o Preliminary Proxy Statement¨o Confidential, for Use of the Commission Only (as permitted byRule 14a-6(e)(2))xþ Definitive Proxy Statement¨o Definitive Additional Materials¨o Soliciting Material UnderRule 14a-12(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨o | Fee computed on table below per Exchange ActRules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

¨o Fee paid previously with preliminary materials.¨ | |

| o | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

(4) Date Filed:

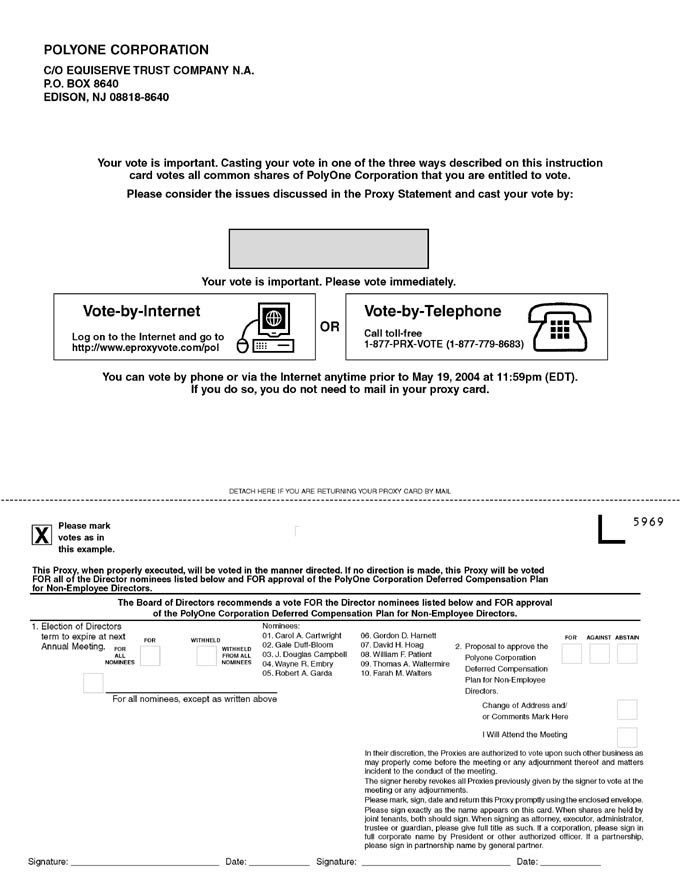

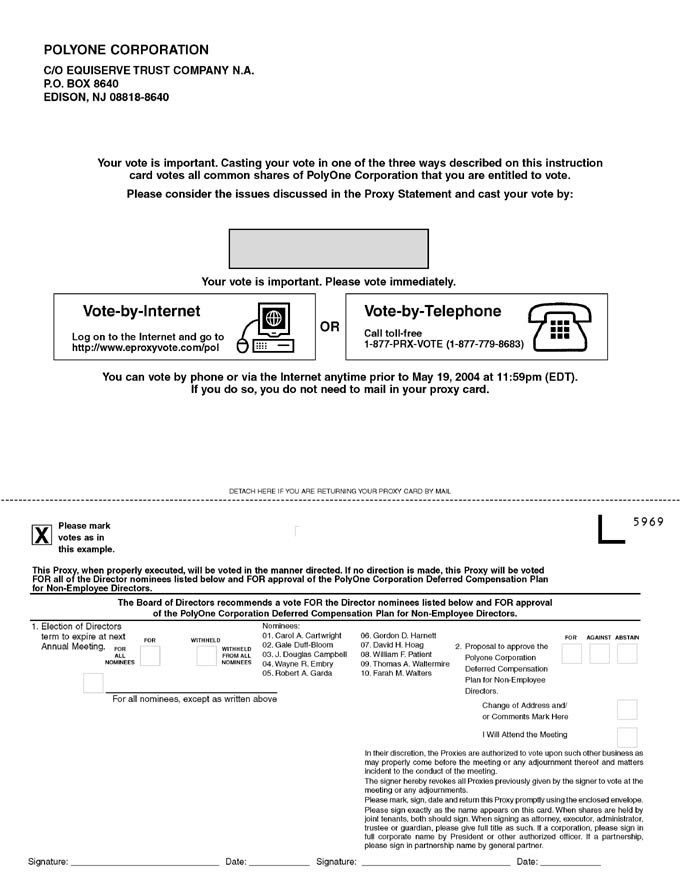

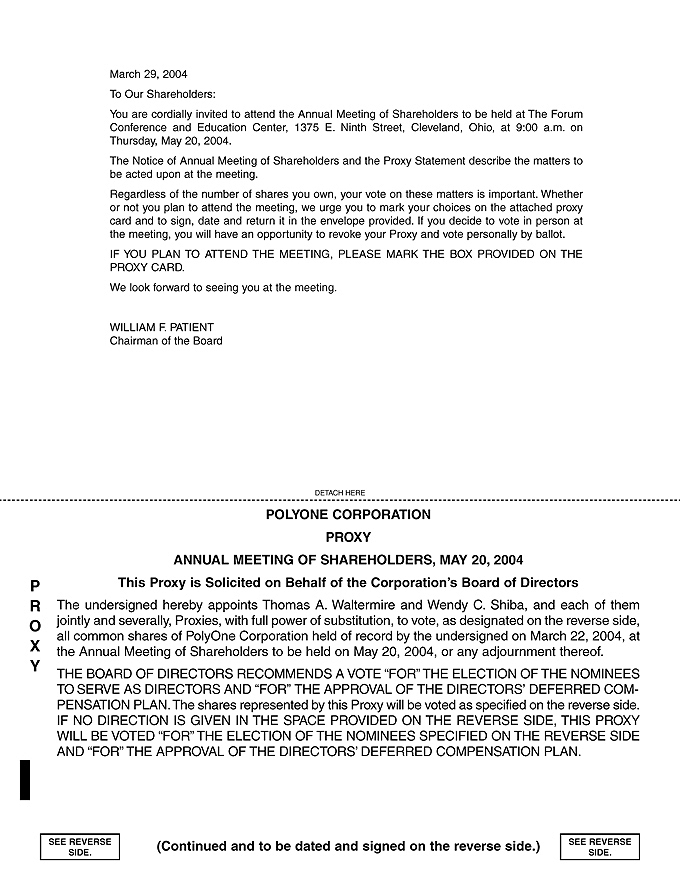

Annual Meeting of Shareholders and Proxy Statement

The Annual Meeting of Shareholders of PolyOne Corporation will be held at The Forum Conference and Education Center, 1375 E. Ninth Street, Cleveland, Ohio at 9:00 a.m. on Thursday, May

20, 2004.10, 2007. The purposes of the meeting are:

1. To elect Directors;

| | 2. | To approveratify the appointment of Ernst & Young LLP as PolyOne Corporation Deferred Compensation PlanCorporation’s independent registered public accounting firm for Non-Employee Directors;the fiscal year ending December 31, 2007; and |

|

| | 3. | To consider and transact any other business that may properly come before the meeting. |

Shareholders of record at the close of business on March

22, 200412, 2007 are entitled to notice of and to vote at the meeting.

For the Board of Directors

WENDY

Senior Vice President, Chief Legal

Officer and Secretary March 29, 200421, 2007

1

POLYONE CORPORATION

PolyOne Center

33587 Walker Road

Avon Lake, Ohio 44012

PROXY STATEMENT

Dated March 29, 200421, 2007

The

Our Board of Directors

of PolyOne Corporation respectfully requests your proxy for use at the Annual Meeting of Shareholders to be held at The Forum Conference and Education Center, 1375 E. Ninth Street, Cleveland, Ohio at 9:00 a.m. on Thursday, May

20, 2004,10, 2007, and at any adjournments of that meeting. This proxy statement is to inform you about the matters to be acted upon at the meeting.

If you attend the meeting, you may vote your shares by ballot. If you do not attend, your shares may still be voted at the meeting if you sign and return the enclosed proxy card. Common shares

of PolyOne represented by a properly signed card will be voted in accordance with the choices marked on the card. If no choices are marked, the shares will be voted to elect the nominees listed on pages 3

andthrough 4

belowof this proxy statement and to

approveratify the

PolyOne Corporation Deferred Compensation Planappointment of Ernst & Young LLP as our independent registered public accounting firm for

Non-Employee Directors.the fiscal year ending December 31, 2007. You may revoke your proxy before it is voted by giving notice to us in writing or orally at the meeting. Persons entitled to direct the vote of shares held by the following

PolyOne plans will receive a separate voting instruction card: The PolyOne Retirement Savings Plan,

PolyOne Retirement Savings Plan for Collective Bargaining Employees, PolyOne Retirement Savings Plan for Collective Bargaining Employees A, DH Compounding

401(k)Company Savings and Retirement Plan

and Trust and PolyOne Canada Inc. Retirement Plan. If you receive a separate voting instruction card for one of these plans, you must sign and return the card as indicated on the card in order to instruct the trustee on how to vote the shares held under the plan. You may revoke your voting instruction card before the trustee votes the shares held by it by giving notice in writing to the trustee.

Shareholders may also submit their proxies by telephone or over the Internet. The telephone and Internet voting procedures are designed to authenticate votes cast by use of a personal identification number. These procedures allow shareholders to appoint a proxy to vote their shares and to confirm that their instructions have been properly recorded. Instructions for voting by telephone and over the Internet are printed on the proxy cards.

We are mailing this proxy statement and the enclosed proxy card and, if applicable, the voting instruction card, to shareholders on or about April 5, 2004. PolyOne’sMarch 26, 2007. Our headquarters are located at PolyOne Center, 33587 Walker Road, Avon Lake, Ohio 44012 and our telephone number is(440) 930-1000.

2

PROPOSAL 1 — ELECTION OF DIRECTORSPolyOne��s

Our Board of Directors currently consists of ten Directors. Each Director serves for a

one yearone-year term and until a successor is duly elected and qualified, subject to the Director’s earlier death, retirement or resignation.

TheOur Corporate Governance Guidelines provide that all non-employee Directors will retire from the Board

met ten times during 2003,not later than the

calendar year being PolyOne’s fiscal year. Each Director is expected to attendfirst Annual Meeting of Shareholders following the

Director’s 70th birthday. In accordance with these Guidelines, Mr. Embry will retire from the Board at the 2007 Annual Meeting of Shareholders.

In 2003, eightFollowing Mr. Embry’s retirement, our Board will consist of

PolyOne’s ten Directors attended the Annual Meeting of Shareholders. PolyOne’s Board of Directors has reviewed the independence of its members as required by the listing standards of the New York Stock Exchange and has determined that none of the nine

non-employee directors has a material relationship with PolyOne and that each such director is independent in accordance with the listing standards of the New York Stock Exchange. PolyOne’s independent Directors meet regularly in executive sessions chaired by William F. Patient, Chairman of the Board. The Board and each Committee conduct an annual self-evaluation. PolyOne’s corporate governance principles and additional governance materials are available at PolyOne’s website at www.polyone.com.Directors.

A shareholder who wishes to suggest a Director candidate for consideration by the Compensation and Governance Committee must provide written notice to

theour Secretary

of PolyOne in accordance with the procedures specified in Regulation 12 of

PolyOne’sour Regulations. Generally, the Secretary must receive the notice

2

not less than 60 nor more than 90 days prior to the first anniversary of the date on which we first mailed our proxy materials for the preceding year’s annual meeting. The notice must set forth, as to each nominee, the name, age, principal occupations and employment during the past five years, name and principal business of any corporation or other organization in which such occupations and employment were carried on, and a brief description of any arrangement or understanding between such person and any others pursuant to which such person was selected as a nominee. The notice must include the nominee’s signed consent to serve as a Director if elected. The notice must set forth the name and address of, and the number of PolyOneour common shares owned by, the shareholder giving the notice and the beneficial owner on whose behalf the nomination is made and any other shareholders believed to be supporting such nominee.

The

Following are the nominees for election as Directors for terms expiring in

20052008 and a description of the business experience of each

nominee appear below.nominee. Each of the nominees is a current member of the Board. The reference below each Director’s name to the term of service as a Director includes the period during which the Director served as a Director of The Geon Company

(“Geon”) or M.A. Hanna Company

(“M.A. Hanna”), each

a predecessor to PolyOne.one of our predecessors. The information is current as of March 21, 2007. | | |

J. Douglas Campbell

Director since 1993

Age — 62

65 | | Retired Chairman and Chief Executive Officer of ArrMaz Custom Chemicals, Inc., a specialty mining and asphalt additives and reagents producer, sinceproducer. Mr. Campbell served in this capacity from December 2003. Served2003 until the company was sold in July 2006. Mr. Campbell served as President and Chief Executive Officer and was a Director of Arcadian Corporation, a nitrogen chemicals and fertilizer manufacturer, from December 1992 until his retirementthe company was sold in 1997. From 1966 to 1992, Mr. Campbell held various positions with Standard Oil (Ohio) and British Petroleum. |

| | |

Carol A. Cartwright

Director since 1994

Age — 62

65 | | Retired President of Kent State University, a public higher education institution, since 1991.institution. Ms. Cartwright served in this capacity from 1991 until her retirement in July 2006. Ms. Cartwright serves on the Boards of Directors of KeyCorp, FirstEnergy and The Davey Tree Expert Company. |

| | |

Gale Duff-Bloom

Director since 1994

Age — 64

67 | | Served asRetired President of Company Communications and Corporate Image of J.C. Penney Company, Inc., a major retailer,retailer. Ms. Duff-Bloom served in this capacity from June 1999 until her retirement in April 2000. From 1996 to June1996-June 1999, Ms. Duff-Bloom served as President of Marketing and Company Communications of J.C. Penney. |

3

| |

Wayne R. Embry

Director since 1990

Age — 66

| | Served as President and Chief Operating Officer, Team Division, of the Cleveland Cavaliers, a professional basketball team, from 1986 until his retirement in 2000. Mr. Embry serves on the Boards of Directors of Kohl’s Corporation and the Federal Reserve Bank of Cleveland. |

| | |

Richard H. Fearon

Director since 2004

Age — 51 | | Executive Vice President, Chief Financial and Planning Officer of Eaton Corporation, a global manufacturing company, since April 2002. Mr. Fearon served as a Partner of Willow Place Partners LLC from 2001-2002 and was the Senior Vice President — Corporate Development for Transamerica Corporation from 1995-2000. |

| | |

Robert A. Garda

Director since 1998

Age — 65

68 | | Retired Director of McKinsey & Company, Inc., a management consulting firm. Mr. Garda served in this capacity from 1978-1994. He served as anExecutive-in-Residence of The Fuqua School of Business, Duke University, since 1997. Mr. Garda servedfrom 1997-2005, as an independent consultant from 1995 to 1997. Mr. Garda served1995-1997 and as President and Chief Executive Officer of Aladdin Industries from 1994 to 1995. From 1967 to 1994, Mr. Garda was with McKinsey & Company and served as a director from 1978 to 1994.1994-1995. Mr. Garda serves on the Boards of Directors of Insect Biotechnology, Inc., VSV, Inc.Edge Seal Technologies and GED, Inc.Ryan Herco Flow Solutions. |

| | |

Gordon D. Harnett

Director since 1997

Age — 61

64 | | Retired Chairman, President and Chief Executive Officer of Brush Engineered Materials Inc., an international supplier and producer of high performance engineered materials, since 1991.materials. Mr. Harnett served in this capacity from 1991 until his retirement in May 2006. Mr. Harnett serves on the Boards of Directors of The Lubrizol Corporation and EnPro Industries, Inc. |

| |

David H. Hoag

Director since 1999

Age — 64

| | Served as |

Edward J. Mooney

Director since 2006

Age — 65 | | Retired Chairman of LTV Corporation, a steel manufacturer, from 1991 until his retirement in 1999, and as Chief Executive Officer of Nalco Chemical Company, a specialty chemicals company. Mr. Mooney served in this capacity from 1991 to September 1998.1994-2000. Mr. HoagMooney also served as Déléqué Général — North America, of Suez Lyonnaise des Eaux from 2000-2001, following its acquisition of Nalco. Mr. Mooney serves on the Boards of Directors of Brush Engineered MaterialsFMC Corporation, FMC Technologies, Inc., The Chubb Corporation, The LubrizolNorthern Trust Corporation and NACCO Industries, Inc. |

3

| | Cabot Microelectronics Corporation. |

| | |

William F. PatientStephen D. Newlin

Director since 2003 2006

Age — 69 54 | | Chairman, of the Board since November 2003. Served as the Chairman of the BoardPresident and Chief Executive Officer of The GeonPolyOne since February 2006. Mr. Newlin served as President — Industrial Sector of Ecolab, Inc., a global developer and marketer of cleaning and sanitizing specialty chemicals, products and services from 2003-2006. Mr. Newlin served as President and a director of Nalco Chemical Company, a manufacturer of specialty chemicals, services and systems, from 1993 until his retirement in 1999.1998-2001 and was Chief Operating Officer and Vice Chairman from 2000-2001. Mr. PatientNewlin serves on the Board of Directors of Navistar International Corporation and is a memberBlack Hills Corporation. |

| | |

Farah M. Walters

Director since 1998

Age — 62 | | Lead Director of theour Board of Trustees of Washington University. |

| |

Thomas A. Waltermire

DirectorDirectors since 1998

Age — 54

| | Chief Executive OfficerMay 2006 and President of PolyOne since August 31, 2000 and Chairman of the Board from August 2000 until November 2003. Prior to the formation of PolyOne at the end of August 2000, Mr. Waltermire served as Chairman of the Board of The Geon Company from August 1999 and Chief Executive Officer and President of Geon from May 1999.QualHealth, LLC, a healthcare consulting firm that designs healthcare delivery models, since 2005. From February 1998 to May 1999, Mr. Waltermire served as President and Chief Operating Officer of Geon. Earlier, Mr. Waltermire held various positions with Geon, including Chief Financial Officer. Mr. Waltermire serves on1992 until her retirement in June 2002, Ms. Walters was the Board of Directors of Nucor Corporation. |

| |

Farah M. Walters

Director since 1998

Age — 59

| | Served as President and Chief Executive Officer of University Hospitals Health System and University Hospitals of Cleveland from 1992 until her retirement in June 2002. Ms. Walters serves on the Boards of Directors of Kerr-McGee Corporation and Alpharma Inc.Cleveland. |

4

CORPORATE GOVERNANCE AND BOARD MATTERS

Director Independence

Our Corporate Governance Guidelines require that a substantial majority of the members of our Board of Directors be “independent” under the listing standards of the New York Stock Exchange (NYSE). To be considered “independent,” the Board of Directors must make an affirmative determination that the Director has no material relationship with us other than as a Director, either directly or indirectly (such as an officer, partner or shareholder of another entity that has a relationship with us or any of our subsidiaries). In each case, the Board of Directors considers all relevant facts and circumstances in making an independence determination.

A Director will not be deemed to be “independent” if, within the preceding three years:

(a) the Director was our employee, or an immediate family member of the Director was either our executive officer or the executive officer of any of our affiliates;

(b) the Director received, or an immediate family member of the Director received, more than $100,000 per year in direct compensation from us, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation was not contingent in any way on continued service);

(c) the Director, or an immediate family member of the Director, is a current partner of Ernst & Young LLP, our external auditor or within the last three years was a partner or employee of Ernst & Young LLP and personally worked on our audit during that time;

(d) the Director was employed, or an immediate family member of the Director was employed, as an executive officer of another company where any of our present executive officers serve on that company’s compensation committee; or

(e) the Director was an executive officer or an employee, or an immediate family member of the Director was an executive officer, of a company that makes payments to, or receives payments from, us for property or services in an amount which, in any single fiscal year, exceeds the greater of $1,000,000, or 2% of such other company’s consolidated gross revenues.

An “immediate family member” includes a Director’s spouse, parents, children, siblings, mothers andfathers-in-law, sons anddaughters-in-law, brothers andsisters-in-law, and anyone (other than domestic employees) who shares such Director’s home.

A Director’s service as an executive officer of anot-for-profit organization will not impair his or her independence if, within the preceding three years, our charitable contributions to the organization in any single fiscal year, in the aggregate, did not exceed the greater of $1,000,000 or 2% of that organization’s consolidated gross revenues.

The NYSE “independent director” listing standards also provide that employment as an interim Chairman, Chief Executive Officer or other officer will not disqualify a director from being considered independent following that employment. William F. Patient, our former Director, ceased serving as interim Chief Executive Officer on February 21, 2006.

The Board of Directors determined that J. Douglas Campbell, Carol A. Cartwright, Gale Duff-Bloom, Wayne R. Embry, Richard H. Fearon, Robert A. Garda, Gordon D. Harnett, Edward J. Mooney, William F. Patient, and Farah M. Walters are independent under the NYSE “independent director” listing standards. In making this determination, the Board reviewed significant transactions, arrangements or relationships that a Director might have with our customers or suppliers.

5

Lead Director

Our independent Directors meet regularly in executive sessions. In 2006, the Board of Directors amended our Corporate Governance Guidelines to allow the independent directors to designate a lead director to preside at executive sessions. The Lead Director acts as the key liaison between the independent directors and the Chief Executive Officer and is responsible for coordinating the activities of the other independent directors and for performing various other duties as may from time to time be determined by the independent directors. In May 2006, the Board elected Ms. Walters to serve as the Lead Director. Mr. Patient served as our Lead Director from February 2006 until his retirement in May 2006.

Board Attendance

The Board met eight times during 2006, the calendar year being our fiscal year. Each Director is expected to attend the Annual Meeting of Shareholders. In 2006, all of our Directors attended the Annual Meeting of Shareholders.

Committees of the Board of Directors; AttendanceThe

As of the date of this proxy statement, our Board has anten directors and the following four committees: the Audit Committee, consisting of Messrs. Harnett, the Chairperson, Garda, Hoag and Patient and Ms. Cartwright; a Compensation and Governance Committee, consisting of Mss. Duff-Bloom, the Chairperson, Cartwright and Walters and Messrs. Campbell, Embry, Garda, Harnett and Hoag; an Environmental, Health and& Safety Committee consisting of Messrs. Embry,and the Chairperson, Campbell and Patient and Ms. Walters; and a Financial Policy Committee consistingCommittee. The following table sets forth the membership of Messrs. Campbell, the standing committees of our Board of Directors, as of the date of this proxy statement, and the number of times each committee met in 2006. The current function of each committee is described below.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Compensation &

| | | | Environmental,

| | | | | |

| | | | | | | | Governance

| | | | Health &

| | | | Financial

| |

| Director | | | Audit Committee | | | | Committee | | | | Safety Committee | | | | Policy Committee | |

| Mr. Campbell | | | | | | | | | X | | | | | X | | | | | X | * |

| Ms. Cartwright | | | | X | | | | | X | | | | | | | | | | | |

| Ms. Duff-Bloom | | | | | | | | | X | | | | | X | | | | | X | |

Mr. Embry(1) | | | | | | | | | X | | | | | X | * | | | | X | |

| Mr. Fearon | | | | X | | | | | X | | | | | | | | | | | |

| Mr. Garda | | | | X | | | | | X | | | | | | | | | | | |

| Mr. Harnett | | | | X | * | | | | X | | | | | | | | | | | |

| Mr. Mooney | | | | | | | | | X | | | | | | | | | | X | |

| Mr. Newlin | | | | | | | | | | | | | | X | | | | | X | |

| Ms. Walters | | | | | | | | | X | * | | | | | | | | | X | |

Number of Meetings

in 2006 | | | | 9 | | | | | 10 | | | | | 2 | | | | | 5 | |

| | | | | | | | | | | | | | | | | | | | | |

X — Member

* — Chairperson

(1) Mr. Embry

and Patient and Ms. Walters.will retire from the Board at the 2007 Annual Meeting of Shareholders.

The Audit Committee which met five times during 2003, meets with appropriate financial and legal personnel and independent auditors to review PolyOne’sour corporate accounting, internal controls, financial reporting and compliance

6

with legal and regulatory requirements. The Committee exercises oversight of

theour independent auditors,

the internal auditors and

the financial

management of PolyOne.management. The Audit Committee appoints the independent auditors to serve as auditors in examining

PolyOne’sour corporate accounts.

PolyOne’sOur common shares are listed on the New York Stock Exchange and are governed by its listing standards. All members of the Audit Committee meet the financial literacy and independence requirements as set forth in the New York Stock Exchange listing standards. The Board of Directors has determined that Mr. Harnett meets the requirements of an “audit committee financial expert” as defined by the Securities and Exchange Commission.

On September 6, 2000, the Board adopted an Audit Committee charter, which was amended on December 10, 2003. A copy of the amended charter is attached to this proxy statement as Appendix A.The Compensation and Governance Committee which met nine times during 2003, reviews and approves the compensation, benefits and perquisites afforded PolyOne’sour executive officers and other highly-compensated personnel. The Committee has similar responsibilities with respect to non-employee Directors, except that the Committee’s actions and determinations are subject to the approval of the Board of Directors. The Committee also has oversight responsibilities for all of PolyOne’sour broad-based compensation and benefit programs and provides policy guidance and oversight on selected human resource policies and practices. To help it perform its responsibilities, the Committee makes use of PolyOne resources, including members of senior management in our human resources, legal and finance departments. In addition, the Committee directly engages the resources of Towers Perrin as an independent outside compensation consultant (the “Consultant”) to assist the Committee in assessing the competitiveness and overall appropriateness of our executive compensation programs. In 2006, the Committee, assisted by the Consultant, analyzed competitive market compensation data relating to salary, annual incentive and long-term incentive. In analyzing competitive market data, the Committee reviewed data from a peer group of similarly-sized U.S. chemical companies and reviewed data from the Consultant’s Compensation Data Bank and other published surveys. The Consultant then assisted the Committee in benchmarking base salaries and annual and long-term incentive targets to approximate the market median. The Consultant, assisted by our human resources department, also prepared tally sheets to provide the Committee with information regarding our executive officers’ total annual compensation, termination benefits and wealth accumulation. More detailed information about the compensation awarded to our executive officers in 2006 is provided in the “Compensation Discussion and Analysis” section of this proxy statement. The Consultant maintains regular contact with the Committee and interacts with management to gather the data needed to prepare reports for Committee review.

The Committee recommends to the Board of Directors candidates for nomination as Directors,

of PolyOne, and the Committee advises the Board with respect to governance issues and directorship practices, reviews succession planning for the Chief Executive Officer and other executive officers and oversees the process by which the Board annually evaluates the performance of the Chief Executive Officer. All members of the Compensation and Governance Committee have been determined to be independent as defined by the New York Stock Exchange listing standards.

On May 15, 2003, the Board adopted a Compensation and Governance Committee Charter, which is available to stockholders on PolyOne’s website at www.polyone.com.4

The Compensation and Governance Committee will consider shareholder suggestions for nominees for election to PolyOne’sour Board of Directors as described on Pagepage 3. The Committee uses a variety of methods for identifying and evaluating nominees for Directors, including third-party search firms, recommendations from current Board members and recommendations from shareholders. Nominees for election to the Board of Directors are selected on the basis of the following criteria:

| | |

| • | Business or professional experience; |

|

| • | Knowledge and skill in certain specialty areas such as accounting and finance, international markets, physical sciences and technology or the polymer or chemical industry; |

7

Business or professional experience;

Knowledge and skill in certain specialty areas such as accounting and finance, international markets, physical sciences and technology or the polymer or chemical industry;

Personal characteristics such as ethical standards, integrity, judgment, leadership and the ability to devote sufficient time to PolyOne’s affairs;

Substantial accomplishments with demonstrated leadership capabilities;

Freedom from outside interests that conflict with the best interests of PolyOne;

The diversity of backgrounds and experience each member will bring to the Board of Directors; and

The needs of PolyOne from time to time.

| | |

| • | Personal characteristics such as ethical standards, integrity, judgment, leadership and the ability to devote sufficient time to our affairs; |

|

| • | Substantial accomplishments with demonstrated leadership capabilities; |

|

| • | Freedom from outside interests that conflict with our best interests; |

|

| • | The diversity of backgrounds and experience each member will bring to the Board of Directors; and |

|

| • | Our needs from time to time. |

The Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board, the balance of management and independent directors, the need for Audit Committee expertise and the evaluations of other prospective nominees.

These criteria have beenThe Committee has established

by the Compensation and Governance Committee asthese criteria that any Director nominee, whether suggested by a shareholder or otherwise, should satisfy. A nominee for election to the Board who is suggested by a shareholder will be evaluated by the Committee in the same manner as any other nominee for election to the Board. Finally, if the Committee determines that a candidate should be nominated for election to the Board, the Committee will present its findings and recommendation to the full Board for approval.

Edward J. Mooney, who is standing for election by the shareholders for the first time, was recommended as a Board member by the Committee.

In the past, the Committee has used Christian & Timbers as a third-party search firm, at our expense, to assist in identifying qualified nominees for the Board. The search firm was asked to identify possible candidates who meet the minimum and desired qualifications, to interview and screen such candidates (including conducting appropriate background and reference checks), to act as a liaison among the Board, the Committee and each candidate during the screening and evaluation process, and thereafter to be available for consultation as needed by the Committee. The Committee did not use the services of Christian & Timbers in 2006, but has asked them, in 2007, to assist it again in identifying potential nominees to the Board.

The Environmental, Health and Safety Committee

which met two times during 2003, exercises oversight with respect to

PolyOne’sour environmental, health, safety, security and product stewardship policies and practices and

itsour compliance with related laws and regulations.

The Financial Policy Committee which met six times during 2003, exercises oversight with respect to PolyOne’sour capital structure, borrowing and repayment of funds, financial policies, management of foreign exchange risk and other matters of risk management, banking relationships and other financial matters relatingmatters.

The Board of Directors has adopted a written charter for each of the standing committees of the Board of Directors. These charters are posted and available on our investor relations internet website at www.polyone.com under the Corporate Governance page. Shareholders may request copies of these charters, free of charge, by writing to

PolyOne.PolyOne Corporation, 33587 Walker Road, Avon Lake, Ohio 44012, Attention: Secretary, or by calling(440) 930-1000.

The Board and each Committee conduct an annual self-evaluation. During 2003,2006, each incumbent Director attended at least 75% of the meetings of the Board of Directors and of the Committees on which he or she served.

Code of Ethics, Code of Conduct and Corporate Governance Guidelines

In accordance with applicable NYSE Listing Standards and Securities and Exchange Commission Regulations, the Board of Directors has adopted a Code of Ethics, Code of Conduct and Corporate Governance Guidelines. These are also posted and available on our investor relations

8

internet website at www.polyone.com under the Corporate Governance page. Shareholders may request copies of these corporate governance documents, free of charge, by writing to PolyOne Corporation, 33587 Walker Road, Avon Lake, Ohio 44012, Attention: Secretary, or by callingShareholder (440) 930-1000.

Communication with Board of Directors Shareholders

and other interested parties interested in communicating directly with the Board of Directors

as a group, the non-management Directors as a group, or with any individual Director may do so by writing to the Secretary, PolyOne Corporation, 33587 Walker Road, Avon Lake, Ohio 44012. The mailing envelope and letter must contain a clear notation indicating that the enclosed letter is

either a “Shareholder-Board of Directors

Communication.Communication” or an “Interested Party-Board of Directors Communication,”

as appropriate.

The Secretary will review all such correspondence and regularly forward to the Board of Directors a log and summary of all such correspondence and copies of all correspondence that, in the opinion of the Secretary, deals with the functions of the Board or Committees of the Board or that she otherwise determines requires their attention. Directors may at any time review a log of all correspondence

received by PolyOnewe receive that is addressed to members of the Board and request copies of any such correspondence. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of

PolyOne’sour internal audit department and handled in accordance with procedures established by the Audit Committee for such matters.

5

Director Compensation of DirectorsPolyOne pays unaffiliated

We pay our non-employee Directors an annual retainer of

$43,000,$100,000, quarterly in arrears,

consisting of a cash retainer of $50,000 and

annually grants to Directors an award of

$17,000$50,000 in value of fully vested common shares.

PolyOne eliminated fees previously paid for each Board and committee meeting attended. PolyOne grantsWe grant the shares quarterly and

determinesdetermine the number of shares to be granted by dividing the dollar value by the arithmetic average of the high and low stock price on the last trading day of each quarter.

We pay individual meeting fees only as follows: fees of $2,000 for each unscheduled Board and committee meeting attended and fees of $1,000 for participation in each unscheduled significant telephonic Board and committee meeting. In addition, the Chairpersons of

theeach committee receive a fixed annual cash retainer, payable quarterly, as follows: $5,000 for Environmental, Health and Safety and Financial Policy Committees

receive a fixed annual retainer of $3,000, payable quarterly. The Chairpersons of theand $10,000 for Audit and Compensation and Governance

Committees receive a fixed annual retainer of $10,000, payable quarterly. PolyOne reimbursesCommittees. We reimburse Directors for their expenses associated with each meeting attended.

The Chairman of the Board of Directors receives a fixed annual retainer of $200,000, payable quarterly.PolyOne generally grants

We grant each new

non-employee Director

who is not an employee of PolyOne at the time of his or her initial election or appointment as a Director an

option to acquire 15,000award of 8,500 common shares.

Each non-employee Director receives an annual option to acquire 6,000 common shares, upon re-election to the Board, effective as of the date of the Annual Meeting. The

options and share awards made to Directors are awarded under

the PolyOne Corporation 2000 Stockeither our Deferred Compensation Plan for Non-Employee Directors or our 2005 Equity and Performance Incentive

Plan or any other present or future stock plan of PolyOne having shares available for these awards.Plan.

Directors who are not our employees of PolyOne may defer payment of all or a portion of their compensation as a Director under PolyOne’sour Deferred Compensation Plan for Non-Employee Directors (the “Directors’ Deferred Compensation Plan”).Directors. A Director may defer the compensation as cash or elect to have it converted into PolyOneour common shares at a rate equal to 125% of the cash compensation amount. Deferred compensation, whether in the form of cash or common shares, is held in trust for the participating Directors. Interest is earned on the cash amounts and dividends, if any, on the common shares deferred accrue for the benefit of the participating Directors.

9

2006 DIRECTOR COMPENSATION

| | | | | | | | | | | | | | | | | | | | | |

| | | | Fees Earned

| | | | | | | | | | | | | |

| | | | or Paid

| | | | Stock

| | | | Option

| | | | | |

| | | | in Cash(3)

| | | | Awards(4)(6)

| | | | Awards(6)

| | | | Total

| |

| Name | | | ($) | | | | ($) | | | | ($) | | | | ($) | |

| J.D. Campbell | | | $ | 62,000 | | | | $ | 50,000 | | | | | — | | | | $ | 112,000 | |

| C.A. Cartwright | | | | 56,000 | | | | | 50,000 | | | | | — | | | | | 106,000 | |

| G. Duff-Bloom | | | | 57,000 | | | | | 50,000 | | | | | — | | | | | 107,000 | |

| W.R. Embry | | | | 60,000 | | | | | 50,000 | | | | | — | | | | | 110,000 | |

| R.H. Fearon | | | | 59,000 | | | | | 50,000 | | | | | — | | | | | 109,000 | |

| R.A. Garda | | | | 59,000 | | | | | 50,000 | | | | | — | | | | | 109,000 | |

| G.D. Harnett | | | | 68,000 | | | | | 50,000 | | | | | — | | | | | 118,000 | |

E.J. Mooney(1) | | | | 4,167 | | | | | 71,359 | (5) | | | | — | | | | | 75,526 | |

W.F. Patient(2) | | | | — | | | | | — | | | | | — | | | | | — | |

| F.M. Walters | | | | 67,000 | | | | | 50,000 | | | | | — | | | | | 117,000 | |

| | | | | | | | | | | | | | | | | | | | | |

| | |

| (1) | | Mr. Mooney was elected as a Director on December 6, 2006. |

|

| (2) | | Mr. Patient served as our Chairman, President and Chief Executive Officer until his retirement from these positions on February 21, 2006. Mr. Patient retired as a member of our Board of Directors on May 25, 2006. All compensation received by Mr. Patient (including compensation for serving as a Director) is reported in the 2006 Summary Compensation Table contained in this proxy statement. |

|

| (3) | | Non-employee Directors may defer payment of all or a portion of their cash compensation as a Director (cash retainer of $50,000, meeting fees, and chair fees) under our Deferred Compensation Plan for Non-Employee Directors. A Director may defer his or her compensation as cash or elect to have it converted into our common shares at a rate equal to 125% of the cash compensation amount. The following have elected to defer all or a portion of their cash compensation into our common shares and have received the 25% premium on the amount deferred into stock: Mr. Campbell ($15,500 in premiums); Ms. Cartwright ($14,000 in premiums); Ms. Duff-Bloom ($10,688 in premiums); Mr. Embry ($7,500 in premiums); Mr. Garda ($7,375 in premiums); Mr. Harnett ($17,000 in premiums); Mr. Mooney ($1,042 in premiums); and Ms. Walters ($8,375 in premiums). |

|

| (4) | | We pay non-employee Directors an annual award of $50,000 in value of fully vested common shares, which the Directors may elect to defer under our Deferred Compensation Plan for Non-Employee Directors. We grant the shares quarterly and determine the number of shares to be granted by dividing the dollar value by the arithmetic average of the high and low stock price on the last trading day of each quarter. We used the following quarterly fair market values in calculating the number of shares: March 31, 2006- $9.180; June 30, 2006- $8.740; September 29, 2006- $8.360; and December 29, 2006- $7.495. |

|

| (5) | | Mr. Mooney received a one time grant of 8,500 common shares upon his election to the Board of Directors. The dollar amount recognized for financial statement reporting purposes for fiscal year 2006 (i.e., the fair market value on the date of grant) is included in this number. |

10

| | |

| (6) | | In 2006, no grants, exercises or vesting of stock options occurred with respect to our Directors. The number of outstanding stock options held by each Non-Employee Director at the end of the fiscal year is set forth in the following table. All of these options are fully exercisable. In addition, the number of fully-vested deferred shares held in an account for each Director at the end of the fiscal year is set forth in the following table. |

| | | | | | | | | | | |

| | | | Option Awards | | | | Stock Awards | |

| | | | Number of

| | | | Number of

| |

| | | | Securities Underlying

| | | | Deferred

| |

| | | | Unexercised Options

| | | | Shares

| |

| Name | | | (#) | | | | (#) | |

| J.D. Campbell | | | | 48,000 | | | | | 102,933 | |

| C.A. Cartwright | | | | 39,000 | | | | | 68,471 | |

| G. Duff-Bloom | | | | 48,000 | | | | | 83,559 | |

| W.R. Embry | | | | 39,000 | | | | | 32,764 | |

| R.H. Fearon | | | | 15,000 | | | | | 0 | |

| R.A. Garda | | | | 61,500 | | | | | 36,892 | |

| G.D. Harnett | | | | 61,500 | | | | | 89,115 | |

| E.J. Mooney | | | | 0 | | | | | 9,749 | |

| W.F. Patient | | | | 0 | | | | | 0 | |

| F.M. Walters | | | | 54,000 | | | | | 84,698 | |

| | | | | | | | | | | |

11

BENEFICIAL OWNERSHIP OF COMMON SHARES The following table shows the number of

our common shares beneficially owned on March

22, 200412, 2007 (including options exercisable within 60 days of that date) by each of

theour Directors and nominees,

any Director who served during 2006, each of the executive officers named in the

2006 Summary Compensation Table on page

1129 and by all Directors and executive officers as a group.

| | | |

Name

| | Number of

Shares (1)

| |

J. Douglas Campbell | | 135,255 | (2)(3) |

Carol A. Cartwright | | 81,393 | (2)(3) |

Gale Duff-Bloom | | 114,676 | (2)(3) |

Wayne R. Embry | | 52,406 | (2)(3) |

Robert A. Garda | | 97,551 | (2)(3) |

Gordon D. Harnett | | 117,259 | (2)(3) |

David H. Hoag | | 99,055 | (2)(3) |

William F. Patient | | 412,475 | (2)(3) |

Thomas A. Waltermire | | 1,103,796 | (3) |

Farah M. Walters | | 103,687 | (2)(3) |

V. Lance Mitchell | | 409,853 | (3) |

W. David Wilson | | 431,072 | (3) |

Wendy C. Shiba | | 115,526 | (3) |

Michael L. Rademacher | | 152,047 | (3) |

17 Directors and executive officers as a group | | 3,929,220 | (2)(3) |

| | | | | | | | | | | | | |

| | | Number of

| | | Right to

| | | Total

| |

| | | Shares

| | | Acquire

| | | Beneficial

| |

Name | | Owned(1) | | | Shares(3) | | | Ownership | |

| J. Douglas Campbell | | | 104,989(2) | | | | 48,000 | | | | 152,989 | |

| Carol A. Cartwright | | | 87,284(2) | | | | 39,000 | | | | 126,284 | |

| Gale Duff-Bloom | | | 84,057(2) | | | | 48,000 | | | | 132,057 | |

| Wayne R. Embry | | | 43,311(2) | | | | 39,000 | | | | 82,311 | |

| Richard H. Fearon | | | 13,437(2) | | | | 15,000 | | | | 28,437 | |

| Robert A. Garda | | | 70,786(2) | | | | 61,500 | | | | 132,286 | |

| Gordon D. Harnett | | | 105,926(2) | | | | 61,500 | | | | 167,426 | |

| Edward J. Mooney | | | 9,749(2) | | | | 0 | | | | 9,749 | |

| Farah M. Walters | | | 85,754(2) | | | | 54,000 | | | | 139,754 | |

| Stephen D. Newlin | | | 219,300 | | | | 0 | | | | 219,300 | |

| William F. Patient | | | 81,431 | | | | 146,000 | | | | 227,431 | |

| W. David Wilson | | | 128,976 | | | | 344,136 | | | | 473,112 | |

| Wendy C. Shiba | | | 67,927 | | | | 116,590 | | | | 184,517 | |

| Kenneth M. Smith | | | 68,487 | | | | 160,892 | | | | 229,379 | |

| Bernard P. Baert | | | 21,000 | | | | 17,072 | | | | 38,072 | |

| 18 Directors and executive officers as a group | | | 1,298,870 | | | | 1,362,132 | | | | 2,661,002 | |

| | |

| (1) | | Except as otherwise stated in the following notes, below, beneficial ownership of the shares held by each individual consists of sole voting power and sole investment power, or of voting power and investment power that is shared with the spouse of the individual. It includes the approximate number of shares credited to the named executives’ accounts in The PolyOne |

6

| our Retirement Savings Plan, a tax-qualified defined contribution plan. The number of shares of common stockshares allocated to these individuals is provided by the savings plan administrator in a statement for the period ending December 31, 2003,2006, based on the market value of the applicable plan units held by the individual. Additional shares of common stockshares may have been allocated to the accounts of participants in the savings plan since the date of the last statements received from the plan administrator. No Director, nominee or executive officer beneficially owned, on March 22, 2004,12, 2007, more than 1% of PolyOne’sour outstanding common shares, except Mr. Waltermire, who owned 1.19%.shares. As of that date, the Directors and executive officers as a group beneficially owned approximately 4.16%2.82% of the outstanding common shares. |

|

| (2) | | With respect to the Directors, except Mr. Waltermire, who is not eligible to participate in the Directors’ Deferred Compensation Plan, beneficial ownership includes shares held under the Directors’ Deferred Compensation Plan as follows: J.D. Campbell, 79,199102,933 shares; C.A. Cartwright, 39,30368,471 shares; G. Duff-Bloom, 60,17883,559 shares; W.R. Embry, 8,85932,764 shares; R.H. Fearon, 0 shares; R.A. Garda, 22,75236,892 shares; G.D. Harnett, 44,94889,115 shares; D.H. Hoag, 40,172 shares; W.F. Patient, 0E. J. Mooney, 9,749 shares; and F.M. Walters, 54,631.84,698 shares. |

|

| (3) | | Includes shares the individuals have a right to acquire on or before May 21, 200411, 2007. The executive officers named in the table (the “Named Executive Officers”) also have the right to acquire common shares upon the exercise of vested stock-settled stock appreciation rights as follows: J.D. Campbell, 54,000 shares; C.A. Cartwright, 33,000 shares; G. Duff-Bloom, 54,000 shares; W.R. Embry, 33,000 shares; R.A. Garda, 55,500 shares; G.D. Harnett, 55,500 shares; D.H. Hoag, 55,500 shares; W.F. Patient 352,000 shares; T.A. Waltermire, 857,483 shares; F.M. Walters, 48,000 shares; V.L. Mitchell, 327,761 shares; W.D.Mr. Newlin, 116,600 SARs; Mr. Wilson, 318,881 shares; W.C.42,000 SARs; Ms. Shiba, 70,313 shares; M.L. Rademacher, 119,159 shares;32,000 SARs; Mr. Smith, 29,800 SARs; and Mr. Baert, 25,000 SARs. The number of shares to be acquired cannot be determined because it depends on the market value of our common shares on the date of exercise and the Directors and executive officers as a group, 2,789,310 shares.applicable withholding taxes. |

12

The following table shows information relating to all persons who, as of March

22, 2004,12, 2007, were known by us to beneficially own more than five percent of

PolyOne’sour outstanding common shares based on information provided in Schedule 13Gs filed with the Securities and Exchange Commission (the “Commission”):

| | | | | | |

Name and Address

| | Number of

Shares

| | | % of

Shares

| |

FMR Corp. 82 Devonshire Street Boston, Massachusetts 02109 | | 12,974,133 | (1) | | 14.16 | % |

| | |

New York Life Trust Company, as Trustee for The PolyOne Corporation Retirement Savings Plan 51 Madison Avenue New York, New York 10010 | | 8,672,028 | (2) | | 9.5 | % |

| | |

Strong Capital Management, Inc. as Investment Advisor for Richard S. Strong 100 Heritage Reserve Menomonee Falls, WI 53051 | | 4,682,735 | (3) | | 5.1 | % |

| | | | | | | | | |

| | | Number of

| | | % of

| |

Name and Address | | Shares | | | Shares | |

| |

| Barclays Global Investors, NA | | | 6,639,933 | (1) | | | 7.2 | % |

45 Fremont Street

San Francisco, California 94105 | | | | | | | | |

| Barrow, Hanley, Mewhinney & Strauss, Inc | | | 5,992,320 | (2) | | | 6.5 | % |

2200 Ross Avenue, 31st Floor

Dallas, Texas75201-2761 | | | | | | | | |

| Dimensional Fund Advisors LP | | | 5,795,047 | (3) | | | 6.2 | % |

1299 Ocean Avenue

Santa Monica, California 90401 | | | | | | | | |

| New York Life Trust Company, Trustee | | | 5,566,350 | (4) | | | 6.0 | % |

51 Madison Avenue

New York, New York 10010 | | | | | | | | |

| FMR Corp. | | | 5,444,700 | (5) | | | 5.9 | % |

82 Devonshire Street

Boston, Massachusetts 02109 | | | | | | | | |

| |

| (1) | As of January 23, 2007, based upon information contained in a Schedule 13G filed with the Commission. Barclays Global Investors, NA, as an investment advisor and reporting on behalf of a group of affiliate entities, has sole voting power with respect to 6,277,281 of these shares and has sole dispositive power with respect to all of these shares. |

|

| (2) | As of February 17, 2004,9, 2007, based upon information contained in a Schedule 13G/A filed with the Commission. Barrow, Hanley, Mewhinney & Strauss, Inc. has sole voting power with respect to 2,729,400 of these shares and has sole dispositive power with respect to all of these shares. |

| |

| (3) | As of February 9, 2007, based upon information contained in a Schedule 13G/A filed with the Commission. Dimensional Fund Advisors LP, as an investment advisor, has sole voting power and sole dispositive power with respect to all of these shares. |

| |

| (4) | As of February 15, 2007, based upon information contained in a Schedule 13G/A filed with the Commission. New York Life Trust Company, as Trustee for The PolyOne Retirement Savings Plan and Excel Polymers Retirement Savings Plan, as a bank, has sole voting power and sole dispositive power with respect to all of these shares. |

|

| (5) | As of February 14, 2007, based upon information contained in a Schedule 13G/A filed with the Commission. FMR Corp., as a holding company reporting on behalf of its subsidiaries, has sole voting power with respect to 1,292,6000 of these shares and has sole dispositive power with respect to all of these shares. |

Share Ownership Guidelines

We have established share ownership guidelines for our non-employee Directors, executive officers and other elected corporate officers to better align their financial interests with those of shareholders by requiring them to own a minimum level of our shares. These individuals are expected to make continuing progress towards compliance with the guidelines and to comply fully within five years of becoming subject to the guidelines. These policies, as they relate to our Named Executive Officers, are discussed in the “Compensation Discussion and Analysis” section of this proxy statement. The required share ownership level for non-employee Directors is 17,000 shares.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that our executive officers and Directors, and persons who own more than 10% of a registered class of our equity

13

(2) | As of February 18, 2004, based upon information contained in a Schedule 13G filed with the Commission. New York Life Trust Company, as Trustee for The PolyOne Corporation Retirement Savings Plan and for various collective investment funds for employee benefit plans and other index accounts, as a bank, has sole voting power and sole dispositive power with respect to all of these shares. |

(3) | As of February 17, 2004, based upon information contained in a Schedule 13G filed with the Commission. Strong Capital Management, Inc. and Richard S. Strong have shared voting and shared dispositive power with respect to all of these shares. |

7

securities, file reports of ownership and changes in ownership with the Commission. Executive officers, Directors and greater than 10% shareholders are required by Commission rules to furnish us with copies of all forms they file. Based solely on our review of the copies of such forms received by us and written representation from certain reporting persons, we believe that, during 2006 and until the date of this proxy statement, all Section 16(a) filing requirements applicable to our executive officers, Directors and 10% shareholders were satisfied, except for one Form 4 filing for each of our executive officers relating to an award of stock appreciation rights on March 8, 2007, which were made two days after the due date. During 2006, we amended one Form 4 report that was timely filed but that omitted, due to a technical complication, a transaction line item relating to a purchase of shares by Mr. Newlin (which shares were reflected in the aggregate number of shares beneficially owned on the original filing).

14

Report of the Compensation Discussion and Governance Committee on Executive CompensationAnalysisThe

Introduction

Our executive compensation programs are approved and overseen by the Compensation and Governance Committee of the Board of Directors (the “Committee”)

, which is

currently comprisedcomposed entirely of

Gale Duff-Bloom, its Chairperson, David H. Hoag, Vice Chairperson, J. Douglas Campbell, Carol A. Cartwright, Wayne R. Embry, Robert A. Garda, Gordon D. Harnett, and Farah M. Walters.independent directors. The Committee is responsible for establishing PolyOne’shas selected and retained an independent compensation consultant, Towers Perrin (the “Consultant”). The Committee works in conjunction with the Consultant and benefit policieswith input from members of senior management, principally the Chairman, President and reviewing PolyOne’s philosophy regardingChief Executive Officer, the Chief Human Resources Officer, the Chief Financial Officer and the Chief Legal Officer.

This report contains management’s discussion and analysis of the compensation awarded to, earned by, or paid to the following executive remuneration to assure consistency with itsofficers (the “Named Executive Officers”)1(:

| | |

| • | Stephen D. Newlin — Chairman, President and Chief Executive Officer |

|

| • | W. David Wilson — Senior Vice President and Chief Financial Officer |

|

| • | Wendy C. Shiba — Senior Vice President, Chief Legal Officer and Secretary |

|

| • | Kenneth M. Smith — Senior Vice President, Chief Human Resources and Chief Information Officer |

|

| • | Bernard P. Baert — Senior Vice President & General Manager, Colors and Engineered Materials, Europe and Asia |

Executive Compensation Programs — Objectives and Overview

The objectives of our executive compensation programs are to: (1) attract, retain and motivate the management team who leads in setting and achieving the overall goals and

objectives of our company; (2) foster apay-for-performance culture by rewarding the achievement of specified financial goals and growth of our share price; and (3) align our goals and objectives with the interests of our shareholders by recognizing and rewarding business

strategy. Each year the Committee reviews market data to assess PolyOne’s competitive position with respect to all aspects of executive compensation and considers and approves changes in base salary and annualresults through incentive

levels for executive officers as well as all awards (including stock options, equity-based awards and long-term incentive plan awards) to executive officers and key employees. The Committee also reviews and approves annual and long-term performance criteria and goals at the beginning of each performance period and certifies the results at the end of each performance period. In addition, the Committee has oversight responsibilities for all of PolyOne’s broad-based compensation and benefit programs.

General Compensation Philosophy

The Committee believes

While we believe that pay should be administered on a total remuneration basis, with consideration of the value of all components of compensation. Total remunerationtotal compensation (which are identified in the 2006 Summary Compensation Table) should be valued and considered when making decisions regarding pay, the primary focus of our executive compensation program is on base salary, annual incentive and long term incentives. We believe that compensation opportunities should be competitive with the industry compensation practices of the companies we compete with for executive talent and serve to attract, retain, motivate and reward employees based upon their experience, responsibility, performance and marketability. Theythat total compensation should be affordable and fair to both employees and shareholders. Incentive

Our incentive programs should createfocus on the critical performance measures that determine our company’s overall success. For positions with significant business unit responsibilities, incentive

(1 Mr. William F. Patient served as PolyOne’s principal executive officer for a strong mutualityportion of interests between executives2006. He had been a Director and shareholders throughChairman of the useBoard since November 2003 and served as President and Chief Executive Officer from October 2005 to February 21, 2006, when Mr. Newlin became Chairman, President and Chief Executive Officer. Mr. Patient served as Lead Director of equity-basedthe Board of Directors from February 21, 2006 until his retirement at the Annual Meeting of Shareholders on May 25, 2006. The compensation andthat Mr. Patient received is disclosed in the selection2006 Summary Compensation Table. He did not participate in our annual or long-term incentive plans or receive the perquisites generally provided to executive officers. Consequently, the references to Named Executive Officers in this report do not apply to Mr. Patient.

15

programs also emphasize success at the business unit level, which often leads to Named Executive Officers at comparable levels being paid differently across the organization. The structure of

performance criteria that are consistent with PolyOne’s strategic objectives.Executive Compensation

PolyOne’s executive compensation program has the following principal components: base salary and annual incentive compensation and long-term incentive compensation. As an executive’s level of responsibility increases, a greater portion of his or her potential total remuneration is based on performance incentives (including stock-based awards) rather than on salary. This approach may result in changes in an executive’s total cash compensation from year to year if there are variations in PolyOne’s performance and/or the performance of PolyOne’s individual business units versus established goals.

The total remuneration programopportunities is designed to be competitivereward executives for the efficient execution of theirday-to-day responsibilities and attainment of short term results, balanced with the total remuneration programs of companies similar to PolyOne within both the specialty chemical industry and a broad-base of industrial companies and is based on the total remuneration programs of companies with which PolyOne competesneed for executive talent. To assess the competitive total remuneration programs of these other companies and to establish appropriate compensation comparisons, the Committee receives advice from an independent compensation consultant and reviews data that is based on the specialty chemical peer group as well as various published surveys.

Base Salaries

The Committee annually reviews the base salaries of executive officers. Prior to the meeting at which the annual review occurs, the Committee is furnished with data on the current total compensation of each executive, current marketplace data for comparable positions, individual performance appraisals and recommended adjustments by the Chief Executive Officer for each executive officer except himself. At the meeting, the Committee reviews all available data and considers and approves adjustments. In addition, the Committee reviews marketplace data for, and the performance of, the Chief Executive Officer and determines the appropriate adjustment.

8

Base salaries for executive officers traditionally are adjusted at the beginning of each year. In view of continuing difficult market conditions and performance that is below expected levels, no adjustments to base salaries were recommended or approved for 2004.

PolyOne accrues for base salary costs on a daily basis and payments to employees are made bi-weekly (normally 26 payments per year). This can create a timing difference between the accrued company cost and the payment to the employee. Approximately every twelve years, a twenty-seventh payment occurs due to the calendar. This will occur in 2004. We want shareholders to know in advance that as a result of this timing difference, the proxy statement in 2005 will report salaries that are 3.85% higher even though no change has been made in senior executive salaries and there has been no increase in accrued cost to the company.

Incentive Compensation

The Senior Executive PolyOne Annual Incentive Plan (the “PolyOne AIP”) provides for awards that are wholly contingent upon the attainment of performance goals established by the Committee. The PolyOne AIP provides for administration by a committee of outside directors but eliminates the Committee’s discretion to increase the amount of incentive awards. The Committee believes that the PolyOne AIP has, in the past, satisfied and will continue to satisfy the Internal Revenue Service’s requirements for “performance-based” compensation under Section 162(m). Under Section 162(m), performance-based compensation is considered a fully deductible expense and not subject to the deductibility limitation under current Internal Revenue Service regulations.

In the beginning of 2003, the Committee approved performance targets related to corporate Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) and business unit operating income. PolyOne’s performance was insufficient to provide awards for EBITDA, and only three of PolyOne’s eight business units achieved operating income levels sufficient to provide for awards. For 2003, the Committee awarded no compensation under the PolyOne AIP to Messrs. Waltermire, Mitchell and Wilson and Ms. Shiba. Mr. Rademacher’s AIP award reflects only the incentive compensation earned for the performance of his business unit, as his award for corporate EBITDA performance was zero. Awards paid for qualifying businesses in 2003 ranged from 28% to 79% of target.

At its meeting on December 10, 2003, the Committee approved 2004 PolyOne AIP performance targets related to corporate debt reduction, free cash flow, operating income, and business unit operating income. A portion of the 2004 PolyOne AIP awards will be paid semi-annually based on performance achieved during the first six months of 2004, to reinforce the urgency of the corporation’s 2004 performance improvement imperatives.

Long Term Incentives

On March 24, 2003, the Committee approved awards to PolyOne’s executive officers under PolyOne’s 2003 – 2005 Strategic Improvement Incentive Plan to take effect on April 1, 2003. The awards were in the form of time-vested stock options and performance units based upon PolyOne’s three-year cumulative operating income for the period of 2003 to 2005. The final amount of the award will be adjusted based on a comparison of PolyOne’s sales revenue growth to a peer group index. The time-vested stock options have an exercise price higher than the fair market value of PolyOne common shares on the date of grant and a ten-year term. The options vest in increments over a three-year period following the date of grant, 35% in each of the first and second years and 30% in the third year. The amount scheduled to vest in the third year may vest earlier based upon PolyOne’s stock price performance. PolyOne limits the number of options awarded based on the typical practice of its peer group.

Performance awards are comprised of performance options and performance cash awards. Performance options are stock options that vest on the third anniversary of the date of grant and have a term of 48 months. These options also have an exercise price higher than the fair market value of PolyOne common shares on the

9

date of grant. Performance cash awards are cash payments based upon PolyOne’s operating income for the three-year period ending December 31, 2005. The final amount of the award will be adjusted based on a comparison of PolyOne’s sales revenue growth to a peer group index. The purpose of these awards is to encourage superior strategic business performance over time. These awards were granted under the PolyOne Corporation 1999 Incentive Stock Plan. As stated above, under Section 162(m), performance-based compensation is not subject to the deductibility limitation under current Internal Revenue Service regulations.

On December 10, 2003, the Committee approved grants effective December 11, 2003 under the PolyOne Corporation 2000 Stock Incentive Plan. PolyOne’s onlysustainable, long-term incentive program for 2004 will be Target Priced Stock Appreciation Rights (“SARs”). Target Priced SARs were granted with exercise terms of 36 months, and with vesting contingent upon the attainment of target prices of $8, $9 and $10 of PolyOne’s common stock. The purpose of PolyOne’s 2004 Target Priced SAR grants is to reinforce the importance of significant improvements in PolyOne’s returns to shareholders over the next three years.

Chief Executive Officer

At Mr. Waltermire’s request, in recognition of business conditions, his base salary was reduced by 10% to $621,600 effective February 1, 2003.

Mr. Waltermire participated in the PolyOne AIP and Strategic Improvement Incentive Plan under similar terms and conditions as other executive officers and as described above. The Committee did not approve an award for Mr. Waltermire under the 2003 PolyOne AIP.

All members of the Compensation and Governance Committee concur in this report.

THE COMPENSATION AND

GOVERNANCE COMMITTEE

OF THE BOARD OF DIRECTORS

Gale Duff-Bloom, Chairperson

David H. Hoag, Vice Chairperson

J. Douglas Campbell

Carol A. Cartwright

Wayne R. Embry

Robert A. Garda

Gordon D. Harnett

Farah M. Walters

February 25, 2004

10

success.

The following table

sets forthoutlines the

major elements of compensation

received for

the three years ended December 31, 2003 by PolyOne’s Chiefour Named Executive

Officer and the persons who were at December 31, 2003 the four other most highly paid executive officers.Summary Compensation Table

Officers. | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Annual Compensation

| | | | | | |

| Element | | | Definition | | | Rationale |

Base Salary | | | • Fixed compensation

payable bi-weekly | | | Long Term Compensation• Standard market practice

• Intended to pay for completing

day-to-day job responsibilities

assigned to the position |

Annual Incentive Plan | | | • Variable, cash compensation that is earned when pre-established annual performance goals are achieved | | | • Standard market practice

• Limits fixed expenses; payment

is required only upon

achievement of specified

goals

• Builds accountability for

important annual financial goals |

Long-Term Incentive

Plan (2 Components) | | | | | | |

| | | | | | | |

60% — Cash-settled

Performance Units

| | | • Variable, cash compensation that is earned when

pre-established three-year financial goals are achieved | | | • Multi-year incentive is standard

market practice

• Emphasizes achievement of

long-term strategic goals and

objectives

• Limits fixed expenses; payment

is required only upon

achievement of specified goals

• Avoids stock dilution through

cash awards

|

40% — Stock-settled

Stock Appreciation

Rights | | | • Variable compensation that vests

only if, and grows in value as, our

share price rises

• Paid in PolyOne common shares | | | • Multi-year incentive is standard

market practice

• Limits fixed expenses; payment

is required only upon

achievement of specified goals

• Emphasizes stock price growth

• Vesting conditions require

growing stock price before any

value can be realized by

participant |

Retirement Plans | | | | | Awards

| |

| | Payouts

| | | | |

Name andU.S. Defined

Contribution PlansPrincipal Position

| | Year

| | Salary($)

| | Bonus($)

| | Other

Annual

Compen-

sation($)(1)

| | | Restricted• Qualified 401(k) defined

Stock

Awards($)(2)

contribution plan | | Options/

| • The qualified defined

SARs(# of contribution plan is a standard

Shares)(3)

tax-qualified benefit offered to

all employees subject to

limitations on compensation and

benefits under the Internal

Revenue Code |

| | LTIP

Payouts

(# of

Shares)

| | All

| | |

16

Other

Compen-

sation($)

| | | | | | |

Thomas A. Waltermire

President and

Chief Executive Officer

Compensation

| | 2003

2002

2001 | | 630,808

690,000

690,000 | | –0–

168,900

276,800 |

| Element | | (1

(1

(1 | )

)

)Definition | | –0–

–0–

705,528 | Rationale |

| | 509,740

299,200

271,000 | • Nonqualified excess 401(k) defined contribution plan | | –0– | • Restores benefits that are limited

–0– by the Internal Revenue Code

–0– in the qualified plan for most

highly-paid executives |

Belgium Defined

Contribution Plan | | 90,586

58,008

41,135 | (3)• Tax-efficient defined contribution plan | | | • Mr. Baert is a participant in a

(3) standard tax-efficient defined

(3) contribution plan provided to

most Belgium employees |

Defined Benefit Plans

(These plans have been closed to new participants since formation of PolyOne) | | | • Qualified defined benefit pension

plan

• Nonqualified, excess defined

benefit plan | | | • Messrs. Wilson and Smith are

participants in a legacy defined

benefit pension plan offered to

certain heritage employees

• Restores benefits that are

limited by the Internal

Revenue Code in the qualified

plan and applies to all eligible

plan participants; as of

December 31, 2004, this

benefit has been frozen |

Post-Retirement

Medical Plan

(This plan has been closed to new participants since formation of PolyOne) | | | • Capped Company-paid subsidy of premiums for medical coverage for retirees similar to coverage provided to active employees | | | • Messrs. Wilson and Smith are

participants in a legacy post-

retirement medical plan offered

to certain heritage employees |

Perquisites | | | • Car allowance

• Financial planning and tax

preparation

• Excess liability insurance

• Relocation benefits | | | • Standard market practice

• Relocation benefits assist

in attracting new executive

talent

• Other perquisites are

modest and are typical for

executives at comparable

companies |

| | | | | | |

Setting the Level of Compensation

We have designed our compensation programs to be competitive with companies of comparable size and industry as well as companies with whom we compete for executive talent. The Committee obtains advice from the Consultant relating to competitive salaries, annual incentives, and long-term incentives. Management and the Committee review the specific pay disclosures of the defined peer group of chemical companies as well as survey data of similarly-sized chemical and other companies, as provided by the Consultant. The Committee discusses and considers this information when making compensation decisions. This process is described in the “Compensation Oversight Processes” section of this report. The Committee manages compensation so as to align each of the pay elements with market practices.

The Committee targets base salaries at the median of observed market practice and sets annual and long-term incentive targets (incentive as a percent of salary) to approximate the market median. We believe the maximum potential annual incentive payouts (no award shall be greater than double the target award) are consistent with the typical market range around target awards.

17

Our actual awards of performance units and stock appreciation rights (“SARs”) are a product of the market data and other considerations. In 2006:

| | |

V. Lance Mitchell

Group Vice President,

Global Plastics

| • | We delivered 60% of the assigned long-term incentive target opportunity for a position, based upon competitive median long-term incentive practices, in the form of cash-settled performance units in order to avoid the dilution associated with share-based awards. |

|

| | 2003

2002

2001• | We delivered the remaining 40% of the assigned long-term incentive target opportunity in the form of stock-settled SARs because they align executive and shareholder interests and because they help preserve cash. |

|

| | 320,889

335,000

335,000• | | –0–

27,700

118,000 | | (1

(1

(1 | )

)

) | | –0–

–0–

342,432 | | 174,160

96,800

87,700 | | –0–

–0–

–0– | | 33,845

27,269

19,936 | (4)

(4)

(4)We assigned a value to a single performance unit and a single SAR based on the Black-Scholes option pricing model. We then determined the actual number of performance units and SARs by dividing the targeted dollar value allocated to each element by the value of a single performance unit and SAR, respectively. |

The following table summarizes the allocation of the compensation opportunity at target that was granted in 2006 to the Named Executive Officers (and not the compensation opportunity that could be earned in 2006), based upon the primary elements of compensation (2006 base salary, Annual Incentive Plan 2006 target opportunity and long-term incentive grants made in 2006, including performance units that will pay out in 2009, if earned). The compensation opportunity is consistent with the company’s overallpay-for-performance philosophy. Generally, employees at more senior levels in the organization, including the Named Executive Officers, have a greater proportion of their compensation tied to incentive compensation. Targeted pay opportunity levels align with the market in each individual pay element.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Proportionate Size of Primary Elements of Compensation | |

| Element | | | Newlin | | | | Wilson | | | | Shiba | | | | Smith | | | | Baert | |

| Base Salary | | | | 24 | % | | | | 36 | % | | | | 40 | % | | | | 40 | % | | | | 43 | % |

| Annual Incentive Opportunity | | | | 24 | % | | | | 18 | % | | | | 20 | % | | | | 20 | % | | | | 22 | % |

| Long-Term Incentive Opportunity* | | | | 52 | % | | | | 46 | % | | | | 40 | % | | | | 40 | % | | | | 35 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

W. David Wilson

Vice President and

Chief Financial Officer*

| | Long-term incentive relating to the performance units for the2006-2008 performance period would be paid in 2009, if earned. |

Benchmarking Competitive Compensation

Each year, we analyze competitive market compensation data relating to salary, annual incentive, and long-term incentive. Periodically, we also analyze competitive market compensation data relating to retirement benefits and perquisites.

In analyzing competitive market data, we draw from two independent sources. First, we review proxy statement disclosures of a peer group of similarly-sized U.S. chemical companies (listed below) to establish an estimate of market compensation for our most senior executives. This approach provides insight into explicit company practices at business competitors or companies facing similar operating challenges. However, it does not provide market information for positions below the senior management level, nor does it address competitors for talent outside the chemical industry.

18

| | 2003

2002

2001 | | 311,754

325,000

325,000 |

| Albemarle Corporation | | –0–

46,900

76,700Eastman Chemical | | (1

(1

(1Hercules Incorporated |

)

)

)Arch Chemicals, Inc. | | –0–

–0–

332,100 Company | | 169,260

94,000

85,800The Lubrizol Corporation |

| A. Schulman, Inc. | | –0–

–0–

–0–Ferro Corporation | | 40,360

24,102

19,371 | (5)

(5)

(5)RPM International Inc. |

| Cabot Corporation | | FMC Corporation | | Spartech Corporation |

| Chemtura Corporation | | Georgia Gulf Corporation | | The Valspar Corporation |

| Cytec Industries Inc. | | H.B. Fuller Company | | |

Note: Lyondell Chemical Company was considered a peer for the purpose of the2006-2008 performance unit plan, but given its growth in size over the period it has been removed from the comparison group.

Second, we review data from Towers Perrin’s Compensation Data Bank and other published surveys, as provided by the Consultant, to augment the peer proxy analysis and provide a more robust sense of market practices. To obtain comparability based on company size, the data either references a specific sample of companies or calibrates the pay of a broad sample of companies against company size. Specific benefits of using the survey data include:

• Addresses more than just the named executive officers;

• Provides target incentive levels;

• Includes similarly-sized chemical companies; and

• Considers similarly-sized companies across a broad range of industries.

This data is used as one of several inputs into management’s and the Committee’s deliberation on appropriate compensation levels. Other inputs include performance, scope of responsibilities, internal equity considerations and other factors.

Elements of Compensation

The following discussion provides additional details about the main elements of compensation for the Named Executive Officers.

Base Salary